The Devaluation of Money And How To Profit From It.

There is a financial force out there that shapes our lives.

It goes by unnoticed day to day.

But as the decades go by it’s stunning just how powerful it is.

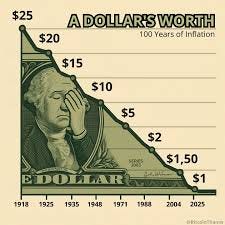

I’m talking of course about the constant devaluing of money.

Here’s a simple illustration of how $10k dollars went from being very valuable, to very little.

1965: $10k would buy you a house.

1975: $10k would buy you 2 new cars!

1985: $10k would buy you 1 new car.

1995: $10k would buy you a good used car.

2005: $10k would buy you a Disney World vacation for a family of 8.

2015: $10k would buy you a Disney World vacation for a family of 4.

2025: $10k will buy you a down payment on a $50,000 vehicle.

It’s clear to see that the dollar is on a bit of a losing streak.

I’m willing to bet on that trend continuing.

What actually causes the dollar to lose it’s value?

Rising prices are no fun.

Most people just assume that the value of money is constant.

$1 = $1

So any time we see rising prices at the grocery store we automatically want to blame someone for being greedy.

It’s a bit tricky to see, but what’s really happening is the value of the dollar is dropping.

This is by design.

Who do we blame?

Every Government, Economist, Banker and Corporation around the world believes that 2% annual inflation is good for the economy.

By eroding the value of the dollar, this encourages you to spend more, borrow more and save less. This money circulates through the economy which creates more jobs and more spending.

The Federal Reserve has the green light to print as much money as it takes to cause the inflation.

Inflation is guaranteed to happen.

How you think about money is the #1 factor in determining your level of wealth.

I like to boil it down to 3 main personality types.

Spenders Mindset - These people want to get rid of their dollars as fast as possible. $1 earned is $1 spent. Having money in the bank is not what they want. They want material items and experiences to feel good about themselves.

Savers Mindset - These people will save and pinch every penny they can. Spending money actually causes them stress. The rainy day fund can never be too secure.

Investors Mindset - These people are actively trying to build wealth and passive income. They delay spending today to enjoy greater wealth in the future.

I tend to think that most people have a little bit of all 3 of these mindsets. It depends on the day.

Spenders and savers get the short end of the stick. They will get fleeced by the devaluing of the dollar.

Investors reap the real benefits. They will preserve their wealth and even profit from the inflation.

So How Do We Profit From This Inflation?

If you can’t beat the system - join it.

Cheer on this inflation.

Let’s buy the assets that outperform the inflation.

Bonds - If the interest rate exceeds the inflation rate, then bonds will slowly build your wealth with low risk.

Gold - Fluctuates wildly, but will always rise in price over the long term.

Farm Land - Most farm land will rent out at 2% of it’s value risk free. If you farm it yourself you can usually earn about 4% on average. It’s also important to know that the value of the Farm Land will usually outpace inflation by itself.

Real Estate - Most rental properties are bought with the intention of a 8% - 10% return in mind. If you borrow a lot of the money you can increase this to 20% - 30%. This comes with additional risks, but higher rewards.

Stocks - The S&P 500 has returned around 10% for over 100 years. Stock prices do fluctuate wildly as well. Be ready to hold this for decades.

We are all powerless to stop this inevitable inflation.

It’s so important to park your money in assets that will rise in value overtime. If you don’t, life will be a struggle forever.

If this all feels overwhelming, consider subscribing to my premium newsletter where I post monthly videos talking about the investments I’m making in my own portfolio. $10 a month is all it costs!