Tax Changes from the BBB

The reconciliation process is over and the Big Beautiful Bill was signed into law on July 4th 2025.

Let’s quickly cover the highlights from a tax perspective.

For Individuals:

Permanent Tax Cuts: The bill makes permanent the individual income tax rates and brackets that were set to expire after 2025, generally extending lower rates for most taxpayers.

Most tax brackets were lowered by 2% back in 2017. This is now permanent.

Increased Standard Deduction: The doubled standard deduction from the TCJA is made permanent and further increased for all filers, with annual inflation adjustments.

This makes returns simpler and fewer people itemize their deductions each year.

Personal Exemptions Eliminated (mostly): The personal exemption deduction is permanently repealed, though a new temporary $6,000 deduction is introduced for seniors (65 and older), phasing out at higher incomes.

This helps lower taxes on seniors.

Child Tax Credit (CTC) Enhanced: The CTC is permanently increased to $2,200 per child (from $2,000) and adjusted for inflation, with certain refundable portions also made permanent.

This helps lower taxes on parents.

State and Local Tax (SALT) Deduction Cap: The $10,000 SALT cap is temporarily raised to $40,000 (with inflation adjustments) until 2030, after which it reverts to $10,000. This increased cap is subject to income limitations for higher earners.

This mainly benefits high earners in high taxed states and cities.

New Temporary Deductions:

No Tax on Tips: A deduction of up to $25,000 for qualified tip income is introduced, phasing out for higher-income earners (temporary, 2025-2028).

This is in addition to the standard deduction. If you make less than $40k you won’t pay any income taxes.

No Tax on Overtime Pay: A deduction of up to $12,500 (or $25,000 for joint filers) for qualified overtime compensation is provided, also with income phase-outs (temporary, 2025-2028).

This is also in addition to the standard deduction. A nice break for workers who put in the extra hours.

Auto Loan Interest Deduction: A deduction of up to $10,000 for interest on auto loans for US-assembled vehicles is included, subject to income limits (temporary, 2025-2028).

This is also in addition to the standard deduction. You don’t need to itemize.

Estate and Gift Tax Exemption: The lifetime estate and gift tax exemption is permanently increased to $15 million per person (indexed for inflation) starting in 2026.

This benefits rich people.

For Businesses:

Permanent Qualified Business Income (QBI) Deduction: The 20% QBI deduction for sole proprietors and pass-through businesses (Section 199A) is made permanent, with some adjustments to phase-in ranges and a new minimum deduction for active qualified business income.

This helps reduce taxes on small businesses

100% Bonus Depreciation: Businesses can permanently expense 100% of the cost of qualified property (e.g., machinery, equipment) acquired and placed in service after January 19, 2025.

This encourages companies to make big capital expenditures.

Immediate Expensing of U.S. R&D Costs: Domestic research and development costs can now be fully deducted immediately. Companies with previously capitalized domestic R&D expenses from 2022-2024 can elect a catch-up deduction.

This encourages innovation across all businesses.

Section 179 Expensing Cap Increased: The cap for Section 179 expensing is increased to $2.5 million, with the phase-out limitation rising to $4 million.

This helps reduce taxes on small businesses.

Summary

Nearly everyone gets some type of tax relief.

I’m always in favor of tax cuts. The lower our taxes are the more the economy can grow.

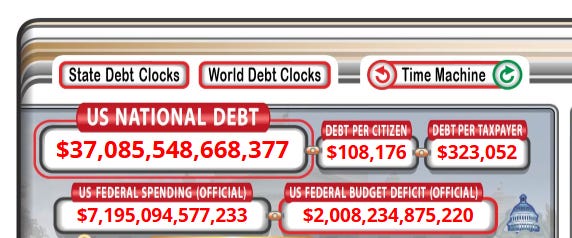

However - deficit spending will keep on increasing the national debt.

Neither party wants to crash our economy with a balanced budget.

These deficits will keep driving inflation higher.

Good thing I wrote a letter on how to profit from the inflation that’s sure to come.

Read it here →